The smart Trick of Offshore Trust Services That Nobody is Discussing

Wiki Article

What Does Offshore Trust Services Mean?

Table of ContentsSee This Report on Offshore Trust ServicesSome Known Details About Offshore Trust Services What Does Offshore Trust Services Mean?Getting The Offshore Trust Services To WorkWhat Does Offshore Trust Services Mean?Fascination About Offshore Trust ServicesOffshore Trust Services Can Be Fun For EveryoneThe 9-Second Trick For Offshore Trust Services

Personal lenders, also larger private companies, are a lot more amendable to work out collections versus borrowers with challenging as well as efficient possession defense strategies. There is no property protection plan that can discourage a very encouraged lender with unrestricted money as well as persistence, however a well-designed offshore trust typically offers the borrower a favorable negotiation.Trustee business charge yearly charges in the variety of $1,000 to $5,000 per year plus per hour prices for additional services. Offshore depends on are except everybody. For most individuals staying in Florida, a residential property security strategy will certainly be as effective for a lot less money. However, for some people facing hard lender issues, the offshore trust is the most effective alternative to secure a significant quantity of possessions.

Borrowers may have extra success with an overseas trust plan in state court than in a personal bankruptcy court. Judgment creditors in state court litigation might be frightened by offshore possession defense trusts as well as might not look for collection of properties in the hands of an offshore trustee. State courts do not have territory over offshore trustees, which indicates that state courts have actually limited treatments to order conformity with court orders.

Offshore Trust Services for Beginners

borrower documents bankruptcy. An insolvency borrower have to surrender all their properties and also lawful rate of interests in residential property anywhere held to the insolvency trustee. Bankruptcy courts have worldwide jurisdiction and are not deterred by foreign nations' refusal to recognize general civil court orders from the united state. A united state bankruptcy judge might urge the personal bankruptcy debtor to do whatever is required to commit the personal bankruptcy trustee all the debtor's assets throughout the globe, consisting of the debtor's helpful rate of interest in an offshore trust.Offshore property security counts on are much less efficient versus internal revenue service collection, criminal restitution judgments, and household sustain commitments. 4. Even if an U.S. court does not have territory over overseas trust possessions, the united state court still has personal jurisdiction over the trustmaker. The courts might try to force a trustmaker to dissolve a trust fund or bring back trust properties.

The trustmaker needs to be eager to surrender legal civil liberties and also control over their trust fund properties for an offshore depend on to properly protect these possessions from united state judgments. 6. Selection of a specialist as well as dependable trustee that will protect an overseas depend on is much more essential than picking an offshore count on territory.

Not known Details About Offshore Trust Services

Each of these nations has count on statutes that agree with for offshore property security. There are refined lawful differences amongst overseas depend on territories' regulations, yet they have extra attributes alike. The trustmaker's choice of country depends mostly on where the trustmaker really feels most comfy positioning assets. Tax treatment of international overseas trusts is very specialized.

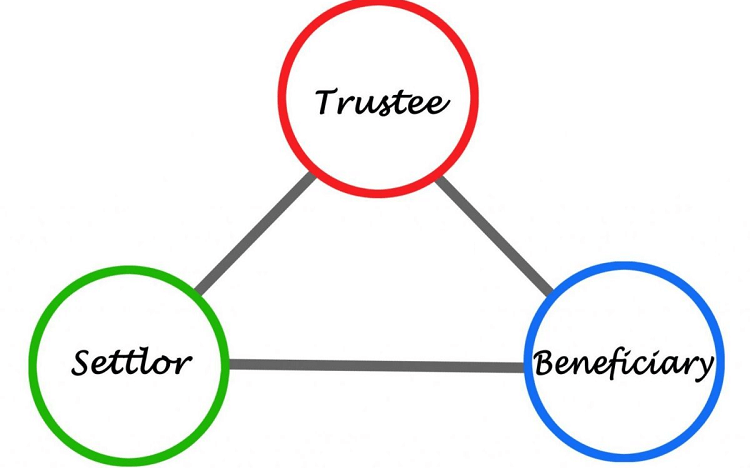

An overseas trust is a standard trust fund that is created under the legislations of an offshore territory. Usually offshore trusts are similar in nature and result to their onshore counterparts; they include a settlor moving (or 'clearing up') possessions (the 'depend on residential or commercial property') on the trustees to handle for the benefit of a person, class or persons (the 'recipients') or, periodically, an abstract purpose.

Liechtenstein, a civil jurisdiction which is in some cases taken into consideration to be offshore, has actually artificially imported the count on idea from typical regulation territories by law. Official stats on trusts are tough to come by as in the majority of offshore territories (as well as in many onshore jurisdictions), trust funds are not called for to be signed up, nonetheless, it is assumed that one of the most common use overseas depends on is as component of the tax as well as financial preparation of affluent people as well as their families.

The Of Offshore Trust Services

In an Unalterable Offshore Depend on might not be changed or liquidated by the settlor. An enables the trustee to make a decision on the distribution of revenues for different courses of beneficiaries. In a Set depend on, the distribution of revenue to the beneficiaries is taken care of and also can not be changed by trustee.Discretion as well as anonymity: Although that an offshore count on is officially registered in the federal government, the parties of the depend on, assets, and also the conditions of the count on are not recorded in the register. Tax-exempt condition: Possessions that are moved to an overseas depend on (in a tax-exempt offshore zone) are not exhausted either when transferred to the depend on, or when transferred or redistributed to the beneficiaries.

8 Simple Techniques For Offshore Trust Services

This has likewise been performed in a number of U.S. states. Counts on in basic go through the regulation in which provides (briefly) that where trust fund residential property includes the shares of a business, then the trustees need to take a positive function in the events on the firm. The rule has been criticised, but remains component of trust fund law in many common legislation territories.Paradoxically, these specialised forms of counts on seem to infrequently be utilized in connection to their initial desired usages.

An offshore trust is click here now a device used for possession defense and also estate preparation that functions by moving properties into the control of a lawful entity based in another country. Offshore trust funds are unalterable, so trust fund proprietors can not redeem ownership of moved assets. They are also complicated as well as expensive. Nonetheless, for individuals with greater obligation issues, offshore depends on can give defense and also better personal privacy along with some tax obligation benefits.

9 Easy Facts About Offshore Trust Services Described

Being offshore includes a layer of security as well as privacy as well as the capability to take care of tax obligations. Due to the fact that the trust funds are not located in the United States, they do not have to comply with U.S. legislations or the judgments of United state courts. This makes it harder for financial institutions and plaintiffs to go after insurance claims versus properties held in offshore trust funds.It can be difficult for 3rd parties to determine the possessions and also owners of overseas counts on, that makes them aid to privacy. In order to establish an overseas trust, the very first step is to select an international nation in which to locate the trusts. Some preferred areas consist of Belize, the Cook Islands, Nevis as well as Luxembourg.

The Buzz on Offshore Trust Services

Transfer the properties that are to be protected into the depend on. Count on owners might initially create a limited liability business (LLC), transfer possessions to the LLC as well as after that transfer the LLC to the depend on. Offshore depends on can be valuable for estate preparation and asset security yet they have limitations.residents who establish overseas trusts can not leave all taxes. Incomes by properties positioned in an offshore depend on are without united state tax obligations. Yet united state people that get distributions as recipients do need to pay U.S. revenue tax obligations on the distributions. United state owners of offshore depends on likewise have to file records with the Irs.

4 Easy Facts About Offshore Trust Services Shown

Corruption can be a concern in some nations. In addition, it's important to pick a nation that great site is not likely to experience political agitation, routine modification, financial turmoil or rapid changes to tax obligation plans that might make an offshore count on less helpful. Lastly, possession security counts on generally have to be established prior to they are needed - offshore trust services.They additionally don't completely protect against all cases and might expose proprietors to risks of corruption and also political instability in the host countries. Nevertheless, overseas counts on are useful estate preparation and also asset security devices. Understanding the best time to use a particular trust fund, and which depend on would certainly provide the most profit, can be confusing.

Take into consideration using our resource on the depends on you can make use of to profit your estate planning., i, Stock. com/scyther5, i, Stock. com/Andrii Dodonov. An Offshore Trust is a traditional Trust formed under the regulations of nil (or reduced) tax obligation Global Offshore Financial. A Count on is a legal game plan (comparable to an agreement) whereby one person (called the "Trustee") in line with a succeeding person (called the "Settlor") authorizations to recognize as well as hold the property to aid different individuals (called the "Recipients").

Report this wiki page